About

Contact details

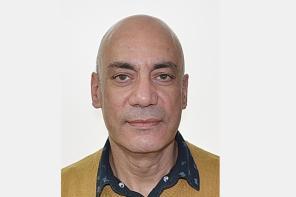

Biography

I am an Associate Professor of Financial Mathematics in the Mathematical Institute, and a Tutorial Fellow in Applied Mathematics at LMH. I am also an Associate Member of the Oxford-Man Institute of Quantitative Finance.

I have a BSc Physics and PhD Theoretical Physics from Imperial College, London. I was later a Royal Society Postdoctoral Fellow in Theoretical Physics at the Niels Bohr Institute, Copenhagen, and then a trader of interest rate derivatives for Security Pacific Hoare Govett, London. I re-entered academia in the field of Mathematical Finance, first as a Research Associate at Imperial College, and then as a Senior Lecturer at Brunel University. I joined the Mathematical Institute at Oxford in 2005.

Research interests

I am a member of the Mathematical and Computational Finance Group and of the Oxford Probability Group.

My research focuses on applications of stochastic control to optimal investment and hedging in incomplete markets. I have worked on problems involving transaction costs, basis risk, and with partial and inside information. I am also interested in Stochastic Portfolio Theory, model-free hedging techniques, and asymptotic methods.

Teaching

I teach Applied Mathematics in College tutorials, covering a range of courses in the first two years of the curriculum. Courses I have tutored include: Introductory Calculus, Dynamics, Fourier Series and PDEs, Multivariable Calculus, Quantum Theory, Special Relativity, and Calculus of Variations.

For the Mathematical Institute I have taught a variety of courses on the Department's two MSc courses in the area of Mathematical and Computational Finance. I have also taught Mathematical Models of Financial Derivatives at the undergraduate level.

I have received two teaching awards for contributions to teaching and learning while in Oxford. In 2007 I received a University award for contributions to the development of the Mathematical Finance MSc. In 2014 I received a Mathematical Institute Department Teaching Award for contributions to the teaching of the Mathematical Finance MSc courses and the undergraduate courses.

Selected publications

- M Monoyios, Malliavin calculus method for asymptotic expansion of dual control problems, SIAM Journal on Financial Mathematics 4 (2013) 884-915

- M Monoyios and A Ng ,Optimal exercise of an executive stock option by an insider, International Journal of Theoretical and Applied Finance 14 (2011) 83-106

- A Danilova, M Monoyios and A Ng, Optimal investment with inside information and parameter uncertainty, Mathematics and Financial Economics 3 (2010) 13-38

- M Monoyios, Utility-based valuation and hedging of basis risk with partial information, Applied Mathematical Finance 17 (2010) 519-551

- M Monoyios, Performance of utility-based strategies for hedging basis risk, Quantitative Finance 4 (2004) 245-255